Renting out your house can be a lucrative venture, but it often comes with its own set of challenges and uncertainties. Whether you’re looking to make some extra income or you’re moving but not ready to sell, understanding the ins and outs of how to rent out your house is crucial. This guide will walk you through the process, providing practical tips and insights to ensure a smooth and profitable experience.

Preparing Your Property for Rent

Assessing Your Property Condition

Before listing your house for rent, it’s essential to ensure it’s in good condition. This doesn’t mean you have to renovate the entire place, but addressing minor repairs can make a significant difference. Think about it, would you want to live in a house with a leaky faucet or peeling paint? A well-maintained property not only attracts better tenants but also allows you to charge higher rent.

Setting a Competitive Rent Price

Determining the right rental price is a balancing act. Set it too high, and your property may sit vacant; too low, and you’re leaving money on the table. Research similar properties in your area to get a sense of the going rate. Consider factors like the size of the house, location, and amenities. Websites like Rightmove and Zoopla can be handy for this.

| Property Type | Location | Average Rent (£) |

|---|---|---|

| 2-bedroom flat | Central London | 3,000 |

| 3-bedroom house | Coventry | 1,200 |

| 1-bedroom flat | Southall | 900 |

Legal Requirements and Documentation

Renting out a property isn’t as simple as just finding a tenant. You need to ensure you comply with legal requirements. This includes obtaining an Energy Performance Certificate (EPC), conducting a Right to Rent check, and drafting a comprehensive tenancy agreement. Ignoring these steps can result in hefty fines or legal disputes.

Finding the Right Tenants

Marketing Your Property

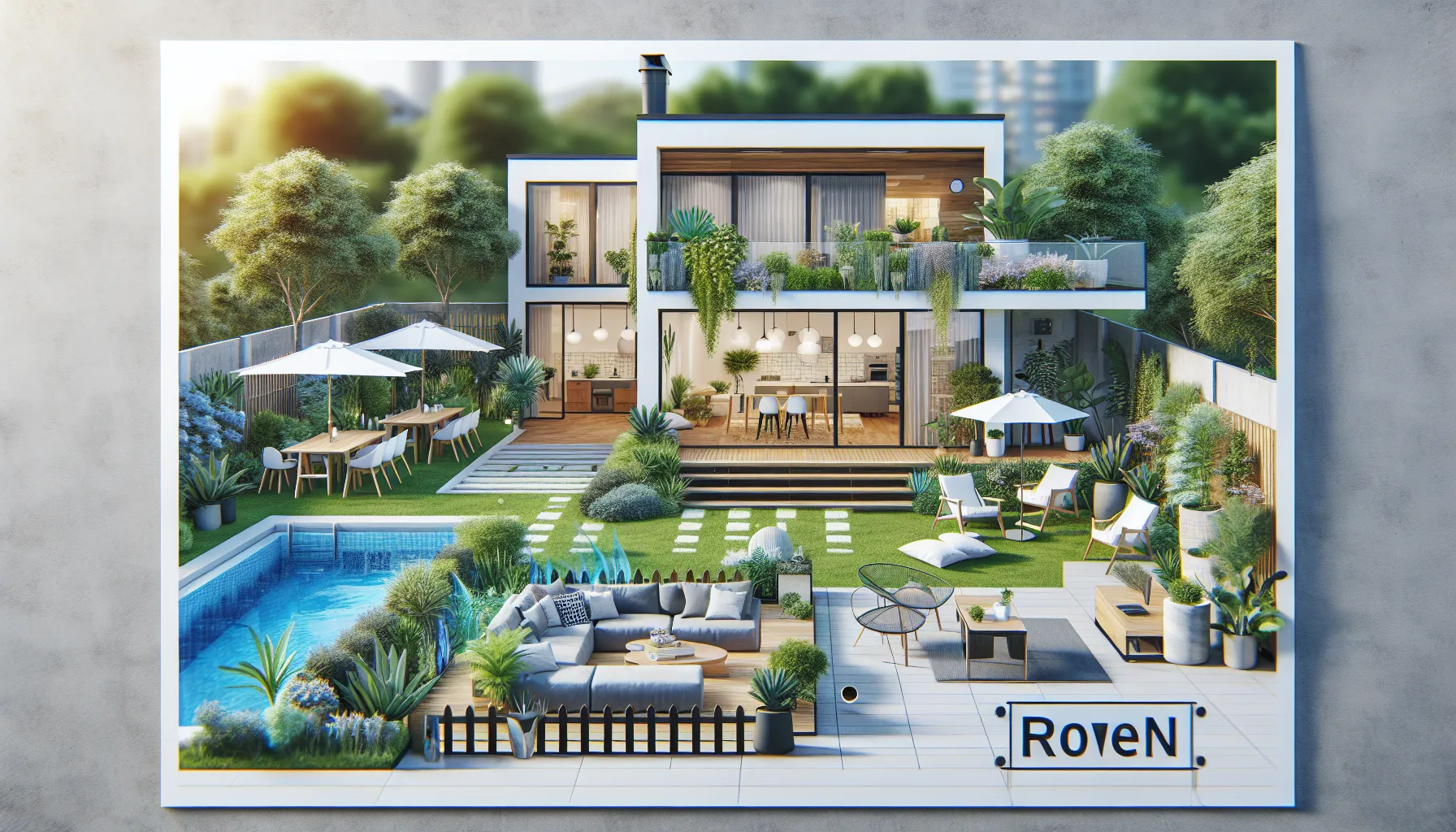

Once your property is ready, the next step is to find tenants. Effective marketing is key here. High-quality photos and detailed descriptions can make your listing stand out. Highlight unique features like a spacious garden, modern kitchen, or proximity to public transport.

Screening Potential Tenants

Finding the right tenants is crucial for a hassle-free renting experience. Conduct thorough background checks, including credit history, employment verification, and references from previous landlords. Remember, a bad tenant can cause more headaches and costs than a vacant property.

Using AnySqft’s AI-Driven Platform

Leveraging technology can simplify the renting process. AnySqft’s AI-driven platform can help match your property with suitable tenants, ensuring a smooth and efficient rental experience. This platform utilizes extensive market data to provide accurate insights and recommendations.

Managing Your Rental Property

Setting Up a Lease Agreement

A lease agreement is a legally binding document that outlines the terms and conditions of the rental. It should cover rent amount, payment due dates, security deposit, maintenance responsibilities, and rules regarding pets, smoking, etc. A clear lease agreement can prevent misunderstandings and legal disputes down the line.

Routine Maintenance and Repairs

Regular maintenance is essential to keep your property in top condition. Schedule periodic inspections and address any issues promptly. This not only preserves your property’s value but also keeps your tenants happy. Happy tenants are more likely to renew their lease and take better care of the property.

Handling Tenant Issues

Despite your best efforts, issues may arise. Whether it’s late rent payments, property damage, or disputes between tenants, handling these problems promptly and professionally is crucial. Establish a clear communication channel with your tenants and be fair but firm in enforcing the lease terms.

Maximizing Your Rental Income

Renovations and Upgrades

Investing in renovations and upgrades can significantly increase your rental income. Focus on improvements that offer the best return on investment, such as updating the kitchen, adding energy-efficient appliances, or creating extra storage space. These upgrades make your property more appealing and justify higher rent.

Tax Benefits and Deductions

Renting out your property comes with certain tax benefits. You can deduct expenses like mortgage interest, property insurance, repairs, and even travel expenses related to managing the property. Consult a tax advisor to ensure you’re taking full advantage of these deductions.

Conclusion

Renting out your house can be a rewarding experience if done correctly. From preparing your property and finding the right tenants to managing and maximizing your rental income, each step requires careful planning and execution. By following this guide, you can navigate the complexities of renting out your house and enjoy a steady stream of passive income.

Remember, the key to a successful rental experience lies in preparation, transparency, and ongoing management. Happy renting!