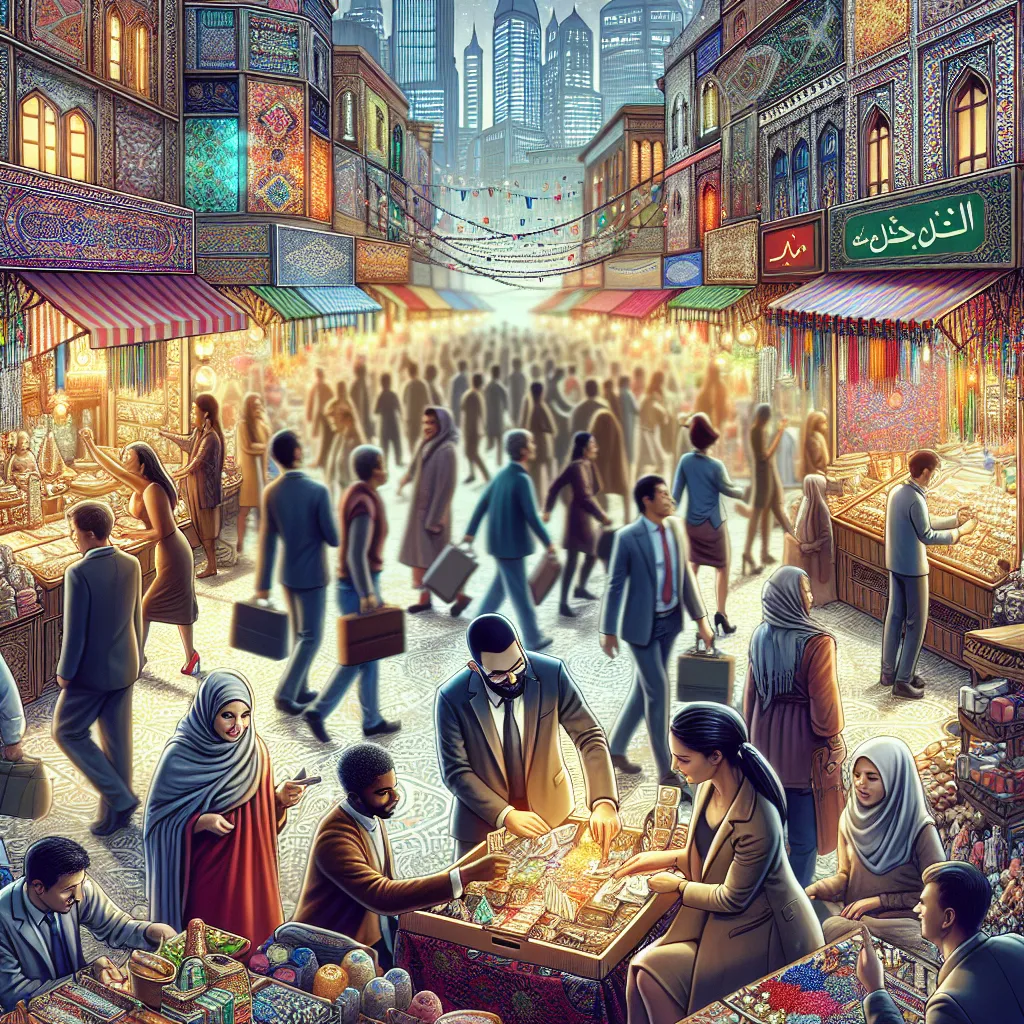

In the bustling world of business, the notion of buying and selling a business might seem daunting, yet it holds a universe of opportunities. You might think this process is filled with complexities, but what if we told you it could be as straightforward as renting or buying a home? Let’s dive into the business for sale landscape, where convenience and strategic planning intersect, creating a pathway for entrepreneurs and investors alike.

Understanding the Business For Sale Market

Why Consider Buying a Business?

Purchasing a business is akin to stepping into a well-oiled machine. It offers the allure of immediate cash flow, established customer bases, and proven business models. Unlike starting from scratch, buying a business provides a solid foundation, reducing the risks and uncertainties commonly associated with new ventures.

- Established Brand: Buying a business means inheriting a brand that customers already recognize and trust.

- Existing Operations: The operations are already in place, allowing you to focus on growth rather than groundwork.

- Financial Records: You gain access to historical financial data, helping you make informed decisions.

The Hidden Gems in the UK Market

The UK’s business market is a treasure trove of unique opportunities, from quaint cafes in charming towns to bustling tech startups in urban centers. Finding the right business is like discovering a diamond in the rough; it requires patience, research, and sometimes a bit of luck.

- Tech Startups: With the UK’s thriving tech scene, startups offer innovative solutions and rapid growth potential.

- Hospitality Ventures: Traditional pubs and modern cafes are cultural staples with significant growth opportunities.

- Retail Businesses: From fashion boutiques to specialty shops, retail offers diverse options for entrepreneurs.

Selling Your Business: A Strategic Approach

Preparing for the Sale

Selling a business isn’t just about listing it on the market; it’s about showcasing its value. Preparation is key, and it starts with a thorough evaluation of your business’s strengths and areas for improvement.

- Valuation: Accurately assess your business’s worth using financial records and market trends.

- Marketing Strategy: Develop a compelling pitch that highlights your business’s unique selling points.

- Legal Considerations: Ensure all legal documentation is in order to facilitate a smooth transaction.

Timing the Sale

Timing can make or break the sale of your business. Just as one wouldn’t sell ice to Eskimos in winter, understanding market conditions and economic climates is crucial.

- Market Trends: Analyze industry trends to determine peak selling periods.

- Economic Factors: Consider the broader economic environment and its impact on potential buyers.

Navigating the Process with AnySqft

The journey of buying or selling a business is much like a dance; it requires coordination, timing, and the right partner. This is where AnySqft’s AI-driven platform shines, offering tailored solutions that make the transaction process as smooth as a well-rehearsed performance. By leveraging cutting-edge technology, AnySqft connects you with the right opportunities, ensuring your business journey is efficient and rewarding.

Conclusion

In the ever-evolving business landscape, opportunities are as abundant as the stars in the sky. Whether you’re buying a business to capitalize on its potential or selling one as part of your next big adventure, understanding the market dynamics is crucial. With the right approach and tools like AnySqft, you can navigate the complexities of the business for sale market with confidence and ease.

Ultimately, the business world is not just about transactions; it’s about connections, growth, and seizing the moment. So, are you ready to step into this world and make your mark?

Business for Sale

When considering a business for sale, it’s essential to evaluate both the opportunities and challenges involved. Here are some key factors to keep in mind:

Key Considerations

- Market Research: Understand current trends and demands in your desired industry.

- Financial Health: Analyze the business’s financial records to gauge profitability.

- Growth Potential: Identify areas for expansion and improvement.

Why Choose AnySqft?

AnySqft provides an efficient platform to explore a wide range of businesses for sale, making your search easier and more effective.

Take Action

Ready to find your ideal business? Visit AnySqft today and unlock your entrepreneurial potential!